Hook: Ever tried filing taxes without knowing what you’re doing? It’s like trying to solve a Rubik’s Cube blindfolded—frustrating and guaranteed to make your brain hurt. But here’s the kicker: mastering tax planning could be your golden ticket to career growth, better paychecks, and even helping others unlock their financial freedom.

In this guide, we’ll break down everything about earning a tax planning certificate, from why it matters to how you can actually survive (and thrive) in those courses—because let’s face it, not all of us were born number-crunchers.

Table of Contents

- Why Getting a Tax Planning Certificate Matters

- Step-by-Step Guide to Earning Your Certificate

- 5 Tips to Ace Your Tax Planning Courses

- Real-World Success Stories: People Who Crushed It

- Frequently Asked Questions About Tax Planning Certificates

Key Takeaways

- A tax planning certificate equips you with specialized skills for personal finance optimization.

- It boosts credibility, job prospects, and earning potential.

- You don’t need to be a math genius—but persistence is non-negotiable.

- Choosing the right course provider is crucial. Spoiler: Not all certificates are created equal.

Why Getting a Tax Planning Certificate Matters

Tax planning might sound dry, but oh boy, is it powerful. Think about it: would you rather give more money to Uncle Sam or keep it for yourself? A whopping 60% of Americans overpay on their taxes each year, simply because they lack proper knowledge (Source: IRS Stats). That’s where a tax planning certificate comes into play—it transforms ordinary people into savvy savers and strategic thinkers.

Let me confess something embarrassing: I once filed my own taxes using TurboTax during college. Long story short, I missed a major deduction that cost me $800. Lesson learned? DIY isn’t always the best route when it comes to complex topics like tax law. With a certification under your belt, you’ll save time, avoid costly mistakes, and position yourself as an expert worth hiring.

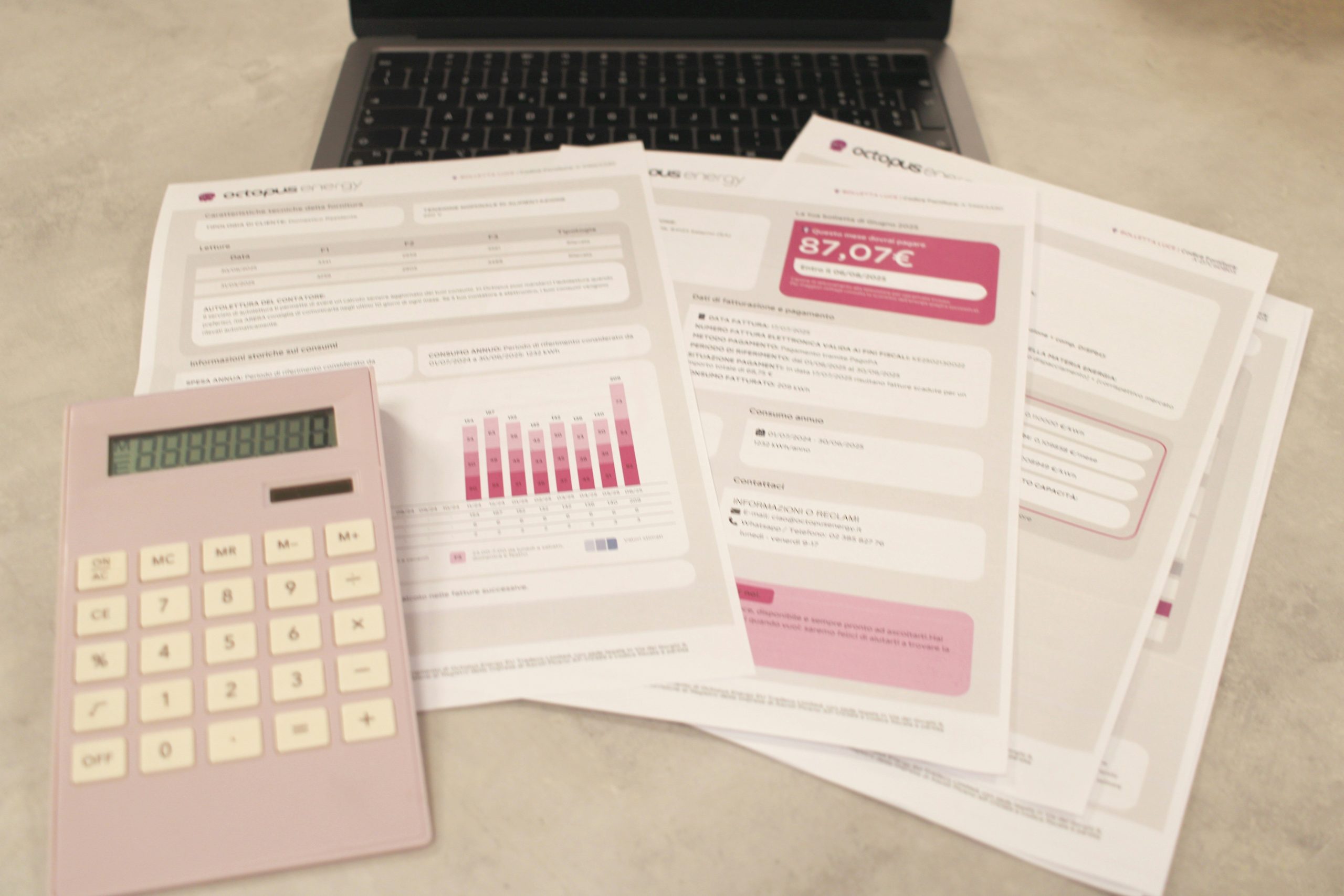

Check out these stats—proof that investing in a tax planning certificate pays off big-time.

Step-by-Step Guide to Earning Your Certificate

So, ready to dive in? Here’s how to go from zero to certified tax pro:

Step 1: Choose the Right Program

Not all tax planning courses are made equal. Some are legit; others are glorified PDFs. Look for programs accredited by recognized bodies (like the NTPI or AICPA). Read reviews, compare syllabi, and check if there’s mentorship available.

Step 2: Set Realistic Goals

Tax planning requires focus. Create a study schedule that fits your life—whether you have kids, a full-time job, or both. Consistency trumps cramming every single time.

Step 3: Study Strategically

If you’re anything like me, sitting through hours of lectures feels impossible. Instead, mix up your learning methods. Use video tutorials, podcasts, flashcards—whatever keeps you engaged.

Step 4: Pass the Exam

This part sounds scary, but hey, you got this. Most exams test practical knowledge, not abstract theories. Pro tip: Practice old exam papers until you dream about deductions.

Step 5: Market Yourself

Congrats, you’re officially certified! Now scream it from the rooftops—or at least update LinkedIn. Build a portfolio showcasing case studies or freelance projects to land clients or promotions.

5 Tips to Ace Your Tax Planning Courses

- Don’t Skip the Basics: Yeah, depreciation schedules may seem boring, but they’re foundational.

- Join Study Groups: Misery loves company—and so does success. Collaborating makes tough concepts easier.

- Use Apps & Tools: Software like QuickBooks or TaxAct can simplify complicated calculations.

- Stay Updated: Tax laws change constantly. Subscribe to newsletters like Forbes Finance Council.

- (Terrible Tip Alert!) Avoid procrastination unless you *love* stress-induced headaches. Seriously, just start early.

Real-World Success Stories: People Who Crushed It

Meet Sarah, a mom of two who took a tax planning course while working nights. Within six months, she started freelancing as a tax advisor, eventually quitting her day job entirely. “I went from overwhelmed to empowered,” she says. Her secret? Picking the right course and sticking to her goals despite sleepless nights.

Then there’s Jake, an accountant who leveled up his career after getting certified. His firm promoted him within a year, citing his newfound expertise as a game-changer. Moral of the story? Hard work + smart choices = big wins.

Proof that success starts with taking the first step.

Frequently Asked Questions About Tax Planning Certificates

Q: How long does it take to earn a tax planning certificate?

A: Typically 3-6 months, depending on the program and your pace.

Q: Is it worth the investment?

A: Absolutely. Certified planners often see salary bumps of 20% or higher.

Q: Can I teach myself instead of taking a course?

A: While possible, structured programs offer valuable resources, networking, and legitimacy.

Conclusion

Earning a tax planning certificate might feel daunting at first glance, but trust us—it’s one of the smartest moves you can make for your personal finance journey. Whether you’re aiming to land a promotion, start a side hustle, or simply stop stressing about April 15th, this credential has got your back.

“Optimist You:” ‘Dive in—you’ve got this!’

“Grumpy You:” ‘Yeah, yeah, only if coffee’s involved.’

Like a Tamagotchi, your future in tax planning needs daily care. Keep learning, stay curious, and watch your efforts multiply faster than compound interest.