Ever signed up for a tax planning course only to feel like you’re drowning in jargon faster than you can say “deductions”? You’re not alone. Many eager learners dive headfirst into tax education—only to discover their instructor lacks the expertise needed to simplify complex concepts. That’s where Expert Tutor Risk Assessments come into play. These evaluations ensure your tutor isn’t just knowledgeable but also equipped to teach effectively.

In this blog post, we’ll unravel why vetting your educator matters—and how it impacts your success in mastering tax planning. You’ll learn:

- The Hidden Pitfalls of Poor Tutoring Choices

- A Step-by-Step Guide to Conducting an Expert Tutor Risk Assessment

- Tips to Spot Top-Tier Tax Planning Educators

- A Real-Life Success Story Featuring Effective Mentorship

Table of Contents

- Key Takeaways

- The Trouble with Unqualified Tutors

- How to Evaluate Your Tutor Like a Pro

- Pro Tips for Choosing a Trustworthy Tutor

- Case Study: From Frustration to Financial Literacy

- Frequently Asked Questions About Tutor Vetting

- Wrapping It All Up

Key Takeaways

- Poorly trained tutors can leave students confused and unprepared.

- An Expert Tutor Risk Assessment helps identify qualified instructors who align with student goals.

- Key traits of great educators include certifications, experience, and positive testimonials.

- Conducting due diligence pays off by improving learning outcomes significantly.

- Personal finance mastery is achievable when guided by competent mentors.

What’s the Big Deal? Why Good Tutors Matter So Much

Confession time: When I first started exploring tax planning courses, I once spent $500 on a so-called expert whose idea of teaching consisted entirely of reading dry IRS forms aloud. (And let me tell you, there was no “chef’s kiss” moment there.) The experience left me feeling frustrated, overwhelmed, and ultimately questioning if I’d ever grasp the material.

The stakes are high: Tax planning mistakes aren’t something you shrug off—they could cost you money or even trigger audits. According to a recent survey, nearly 68% of self-taught taxpayers overpay on taxes simply because they don’t understand credits and deductions fully. A bad tutor amplifies confusion, potentially leading to costly errors down the road.

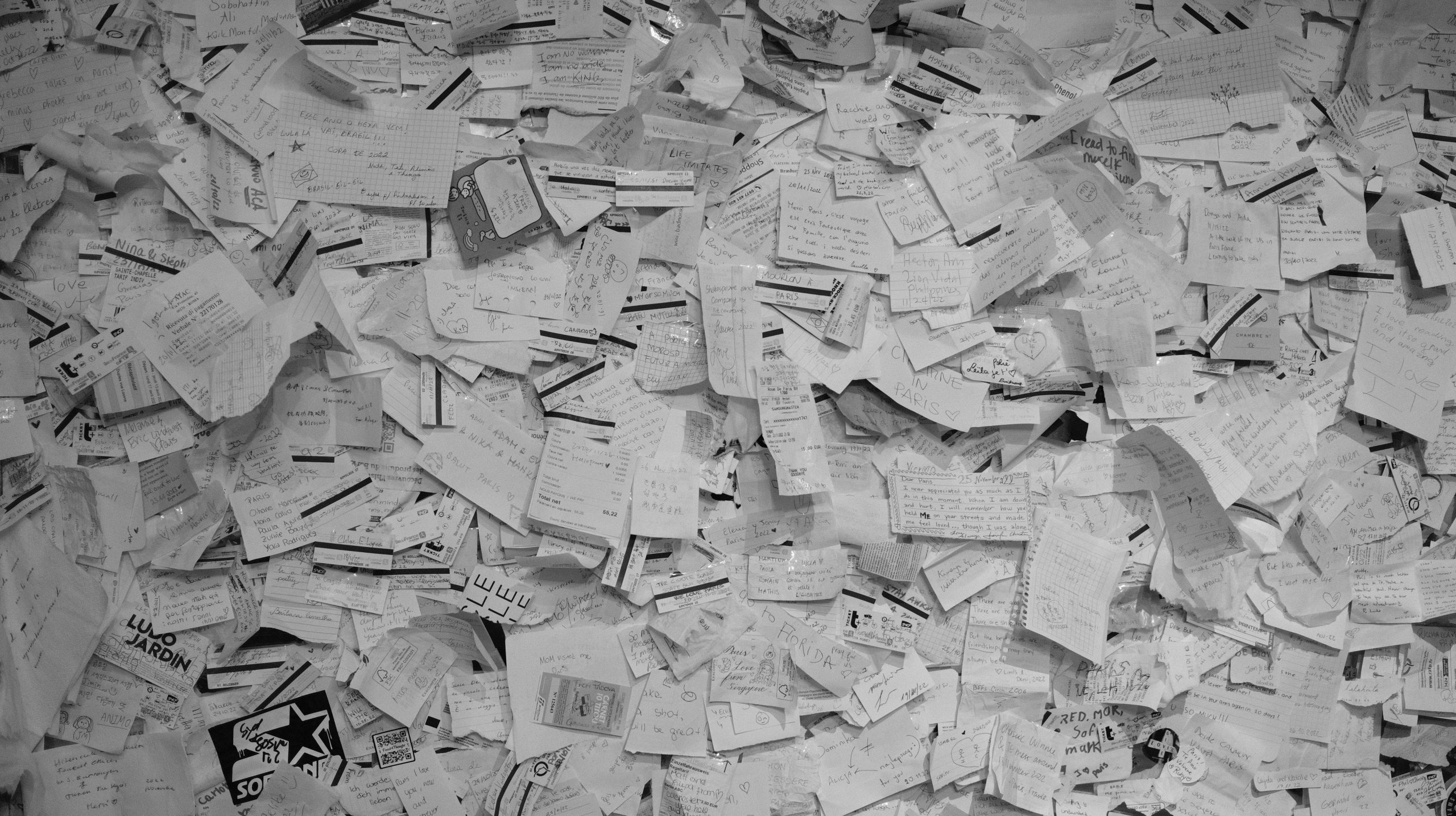

Understanding tax planning saves both stress and cash!

The Grumpy Optimist Dialogue

Optimist You: “I’m sure any tutor will do fine as long as they know taxes!”

Grumpy You: “Have you met my last teacher? They made Netflix buffering look engaging.”

How to Perform an Expert Tutor Risk Assessment Yourself

Here’s the truth: Finding a top-notch educator doesn’t have to be as painful as filing your own return. Follow these steps to evaluate potential tutors:

Step 1: Review Credentials and Certifications

Check whether the tutor has relevant qualifications, such as CPA (Certified Public Accountant) credentials or specialized certifications in financial education.

Step 2: Investigate Teaching History

How long have they been teaching personal finance? Do past students rave about them online? Testimonials matter big-time here.

Step 3: Analyze Course Content Samples

Request samples of their lesson plans. If their PowerPoint slides put your laptop fan into overdrive during opening animations, run far away.

Step 4: Seek Interactive Elements

Does the course involve live Q&A sessions, quizzes, or hands-on activities? Successful learning thrives on engagement—not passive information dumps.

Pro Tips for Identifying Stellar Tax Planning Instructors

- Ask Around: Word-of-mouth recommendations from peers beat generic reviews every day.

- Watch Out for Buzzwords: Be skeptical of anyone using terms like “guaranteed wealth” without substance backing it up.

- Show Me the Money: Compare tuition costs versus actual value delivered. Cheapest isn’t always best, folks.

- Terrible Tip Alert: DON’T pick someone based solely on flashy marketing campaigns. Marketing gurus ≠ tax gurus.

Success Story: Turning Failure Into Financial Mastery

Meet Sarah—a single mom working two jobs who decided to tackle her chaotic finances through tax planning. Initially, she enrolled in a low-cost course led by an underprepared tutor. After floundering through weeks of confusion, Sarah opted for a new program helmed by a certified CPA with years of practical experience. Within months, she learned strategies that saved her thousands annually—and even boosted her credit score!

Sarah found success thanks to a qualified mentor.

Frequently Asked Questions

Q: How much should I budget for quality tutoring?

A: Prices vary widely depending on specialization and session format. Expect anywhere from $50-$200 per hour for premium services.

Q: Can AI tools replace human tutors?

A: Not quite yet! While tech assists with calculations, interpersonal guidance remains irreplaceable.

Q: What red flags indicate poor-quality teaching?

A: Lack of responsiveness, outdated materials, absence of structure—all scream caution.

Final Thoughts

To summarize, making informed decisions when selecting a tax planning tutor hinges on thorough Expert Tutor Risk Assessments. By reviewing qualifications, seeking feedback, and comparing offerings, you empower yourself to master personal finance confidently.

Remember: Knowledge protects your wallet more than anything else. And hey, remember Tamagotchis? Yeah, nurturing your financial literacy requires daily care too. Happy learning!